Post Graduate Program in General Management | Goa Institute of Management

In association with

Credentials

Post Graduate Program in General Managementfrom GIM

Recommended 8-10 hrs/week

11 MonthsHiring Partners

300+Start date

Coming SoonStarting at Rs.3,403 p.m.

EMI OptionsProgram Overview

Key Highlights

"Our aim is simple: We strive to create high-impact, hands-on experiences that prepare students for meaningful and productive careers.”

- Ronnie Screwvala, Co-Founder, upGrad

Accreditations & Rankings

Syllabus

Best-in-class content by leading faculty and industry leaders in the form of videos, cases and projects.

Top Subjects you will learn

Job Opportunities

Who Is This Program For?

Minimum Eligibility

- GIM ranked #33 in the management category, as per NIRF Rankings 2023

- Become a business management expert in 11 months

- Learn from industry leaders

- Network with like minded professionals

Explore our Learning Platform

Discover Alumni similar to your profile

Find upGrad alumni profiles and know more about their career path, specialisation and more!

Instructors

Learn from India’s leading industry professionals and GIM faculty

Rohit Prabhudesai

Lakshmi Vishnu Murthy Tunuguntla

Syllabus

Best-in-class content by leading faculty and industry leaders in the form of videos, cases and projects, assignments and live sessions

Business Communication

- Effective Communication

- Personal Branding

- Graded Group Project- Pitch deck

Marketing Management

- Fundamentals of Marketing

- Consumer Behaviour, Marketing Channels

- Marker Motion Simulation

Sales and Distribution

- Sales and Sales Management

- Channel Management, Territory Management

- Graded Project - Castrol

Business Strategy

- External and Internal Analysis

- Driving Growth

- Graded Group Project

Business Economics

- Micro Economics

- Macro Economics

- Extra Week

- Covid-19 project

Accounting and Finance

- Module 1

- Module 2

- Extra Week

- Course Project

Operations and Supply Chain

- Strategic Planning in Supply Chain

- Sourcing, Logistics and Distribution

- Graded Project

Decision Sciences

- Module 1

- Module 2

- Extra week

- Course Project

OB, HR & Legal

- Organisational Behaviour

- HR for Non-HR Managers, Business Law & Ethics

- Lisa Benton Project

Leadership & Decision Making

- Attributes of a Leader

- Leading Teams and Leading Organisations

- Subjective Submission 1

- Leadership and decision making

- Group decision making

- Subjective Submission 2

- Introduction to Change Management

- Implementing Change Management

- Subjective Submission 3

Elective Course (choose any one)

- Business Analytics Specialization

- Leadership Strategy Specialization

- Market Research Specialization

- Accounting and Finance Specialization

- Supply Chain Specialization

- HR Specialization

Enterprise and Risk Management

- Risk and Risk Management

- Enterprise Risk Management Process

- Graded Project

Digital Business Innovation

- Digital Innovation

- Digital Businesses

- Graded Project: Hamleys

Industry Projects

Marker Motion Simulation

Identify a target segment based on customer needs and effectively implement a positioning strategy to increase revenue and profits.

COVID 19

Apply microeconomic and macroeconomic concepts in the context of the pandemic.

New Heritage Doll Company

Decide which projects to invest in depending upon quantitative factors with the objective of maximising the value of the company.

Lisa Benton Case Study

Solve dilemmas and conflicts at the workplace through application of organisational behaviour concepts.

The upGrad Advantage

Learning Support

- Receive unparalleled guidance from industry mentors, teaching assistants and graders

- Receive one-on-one feedback on submissions and personalised feedback on improvement

- Student Support is available 24*7 all days for non-academic queries

- You can write to us via studentsupport@upgrad.com Or for urgent queries, use the "Talk to Us" option on the Learn platform.

Doubt Resolution

- Timely doubt resolution by Industry experts and peers.

- 100% Expert-verified responses to ensure quality learning

- Personalised expert feedback on assignments and projects.

- Regular live sessions by experts to clarify concept related doubts.

Networking

- Fun-packed, informative and career building workshops Sessions by industry professionals and professors.

- Group activities with your peers and alumni

- Live sessions by experts on various industry topics

- One-on-one discussions and feedback sessions with industry mentors

Career Impact

Admission Process

There are 3 simple steps in the Admission Process which is detailed below:

Step 1

Complete Application

Fill the application form available online at upGrad.com

Step 2

Block your Seat

Block your seat by paying the block amount

Step 3

Complete the Payment

Based on your previous educational performance, you may be required to take an enrolment test

₹ NaN (No taxes applicable)*

Program fees (with Immersion): INR 1,83,000 (No taxes applicable)

Disclaimer:

Empowering learners of tomorrow

Over 2,300 students have completed this course and started working at their dream job, whats stopping you?

Student Reviews

Aravind Vorungati

Shaifali Aggarwal

Akshay Mathur

Refer someone and Earn upto INR 50,000 Cashback/Vouchers, on every successful enrollment!

Your friend also gets an instant scholarship/free course!

Frequently Asked Questions

Course Eligibility

Who is this program for?

This program is for Sales and Marketing Executives, Managers and Entrepreneurs looking for an in-depth understanding of management and leadership, IT Professionals looking to switch industry.

Is there a minimum qualification for this program?

50% in Bachelor’s degree issued by any university under UGC

Exceptions:

- Candidates with <50% in graduation but >50% in Master's will be eligible

- Candidates with <50% in graduation but >50% in PG Diploma will be eligible

- Candidates who are fully qualified CA/CS/ICWA and have also done graduation will be eligible even if they have <50% in graduation

What is the admission process?

The admissions process is completely online. Following are the key steps in the application process:

- Step 1 - Complete Application: Fill the application form available online at upGrad.com

- Step 2 - Block your seat: Block your seat by paying the block amount

- Step 3 - Complete the Payment: Based on your previous educational performance, you may be required to take an enrolment test.

Course Curriculum

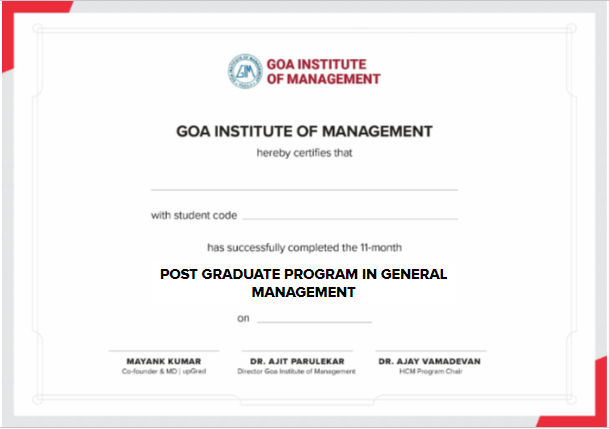

What kind of certification will I get after completion of this course?

Post this program, you will get an industry relevant and recognised Post Graduate Program in General Management from Goa Institute of Management in association with upGrad.

How much time do I need to spend to achieve success in the program?

You will need to spend 8-10 hours per week to get optimum results and learning.

Overall, this program will have 100 hours of video content (~ 2.5 hours per week) broken down into small easy-to-complete segments that you can watch on the go-across devices. The remaining hours of engagement will be a mix of industry projects, live instructor sessions, mentoring sessions.

Can I do the Post Graduate Program in General Management from my city?

You can learn this program from any city in India and abroad.

How do I know that this program’s curriculum is the best?

How would these real-industry projects help me?

How is this program better than other diploma programs?

The program has been made in collaboration with faculty from India’s top-ranked MBA college and industry leaders from India’s leading corporates. This ensures that the curriculum is not only updated with the latest academic developments but is also absolutely job relevant. The program familiarises the student with different aspects of business, such as Sales and Marketing, Finance, Legal, HR, etc., which are important at the managerial level.

What kind of offline networking events are conducted?

Every quarter, offline networking events called upGrad BaseCamps are conducted in major cities of Delhi, Mumbai, Bangalore, etc. Alumni of all batches of the program are invited to these events, which help you make connections with your fellow participants, along with engagement in group projects, industry interaction and much more. Career Workshops for freshers and young professionals with F2F counseling will also be held at these BaseCamps.

What kind of support does upGrad offer?

- Student support is available 24*7, you can reach out to us via the learn portal.

- Extensive academic support through the Discussion Forum, weekly TA-Sessions. Just like in a university, your batchmates will help you with any academic queries. This will happen via the Discussion Forum.

- Other than your peers, you also have TAs (Teaching Associates) for any academic query. Your academic queries will be solved by the Faculty and TAs in 36-48 hours.

Are the offline sessions and live sessions mandatory?

No, these are not mandatory but are additional facilities that help in networking, career growth and practical learning.

Payment

How much do I pay to block my seat?

You need to pay ₹15,000 to block your seat.

Is there any deferral or refund policy for this Program?

Refund Policy: (Programs without prep-session component)

- Student must pay applicable caution money for the enrollment of the course. This will be adjustable against the total course fee payable by the student.

- You can claim a refund for the amount paid towards the Program at any time, before the Program Start Date, by visiting www.upgrad.com and submitting your refund form via the "My Application" section under your profile. You can request your Admissions Counselor to help you in applying and withdrawing for a refund by sending them an email with reasons listed.

- There shall be no refund applicable once the program has started. This is applicable even for those students who could not complete their payment, and could not be enrolled in the batch opted for. However, the student can avail pre-deferral as per the policy defined below for the same.

- Once the student pays block amount, "any" refund shall be subject to deduction of ₹10,000 processing charges.

- Student has to pay the full fee within 15 days of payment of caution money or cohort start date, whichever is earlier, otherwise, the admission letter will be rescinded and processing fee of ₹10,000 will be levied.

- Refund shall be processed to an eligible student within 30 working days from the date of receipt of written application from him/her in this regard.

Deferral Policy: (Post Program Commencement)

- If a student is facing severe issues in dedicating time to the course, we provide the opportunity for the student to defer to another batch.

- A student can request for deferral only once and to either of the scheduled cohorts to start in the next 1 year to either of the next two consecutive cohorts from the start date of the initial batch in which the student was originally enrolled for.

- The student will be required to pay a deferral fees of 10% of the total course amount fee + Taxes if any along with the differential program fees between the two cohorts.

- The deferral request will be approved once the deferral fee is paid.

- Till this is completed, the student will be assumed to be continuing in the same cohort.

- The student has 7 days (including holidays and weekends) from the date of deferral request to make the payment of the deferral fee post which the deferral request will expire, and the student will continue as part of the current cohort.

- If the student completes the deferral payment, the student's login will be disabled, the student will leave the deferred cohort and the student will start learning on the new cohort from the point of the last assignment that was graded in the deferred cohort. All grades and progress until that point will be carried forward as it is to the new cohort. For clarification, the grades of the graded assignments will be carried forward, whether or not the student had submitted these grading during the initial stage.

- The deferral can only be requested during the batch for which the student has enrolled is ongoing. Once the batch has completed, deferral requests shall not be entertained. For clarification, the batch completion here shall mean the "last grace deadline" as communicated by upGrad.

Deferral Policy: (Pre Program Commencement)

- If a student, due to unavoidable circumstances, is unable to commence with the cohort and requests for a deferral before the cohort starts, we provide the opportunity for the student to defer to another cohort.

- To do so, the student will be required to pay 50% of the total Program fee amount (inclusive of taxes) before the deferral can be approved. Till this is completed, the student will be assumed to be continuing in the same cohort.

- A student can request for deferral to any of the cohorts starting in the next 3 months from the start date of the initial batch in which the student was originally enrolled. For the first deferral request, subject to the point no. 2 of the Pre-Program Deferral Policy, no additional charges shall be levied.

- If a student wants to defer his enrolment a second time, such student will have to make an additional payment of Rs.10,000 as Deferral fee, and this amount shall be non-refundable under any circumstances. Once this payment is done, students will be eligible to defer to any of the cohorts starting in the next 3 months from the current cohort.

- The student has time till the current cohort launch date to make the payment of the balance 50% Program fee, post which the deferral request will expire. Once the deferral window expires and if such a student wants to withdraw his or her enrolment from the said Program, the refund policy will be applicable.

- The student shall be liable to pay the differential Program fees between the two cohorts if any.

No Cost Credit Card EMI FAQ's

0% EMI with Finance partners /Credit card option availability will vary program wise.

1. Which banks allow using 0% Credit card EMI or Credit card EMI?

No cost EMI is available on credit cards from all major banks (American Express, Bank of Baroda, HDFC Bank, ICICI Bank, IndusInd Bank, Kotak Mahindra Bank, RBL Bank, Standard Chartered, Axis Bank, Yes Bank, State Bank of India, CITIBANK and HSBC).

2. Is there any minimum transaction limit ?

Yes. 50000 is the minimum.

3. Standard Chartered Bank offers 18 or 24 months No Cost EMI ?

No. ONLY 12 months is available irrespective of the Program enrolled.

4. Will I have to pay any extra amount for EMI transaction?

If you are availing 0% credit card EMI, upGrad will not charge any processing fees or down payment for these transactions. Your bank may levy GST or other taxes on the interest component of the EMI.

5. Are there any fees or down payment?

Certain banks charge nominal processing fees between INR 99 - 500 on 0% Credit Card EMI transaction. If charged, will be billed in the first repayment installment.

6. Can I use my International credit card for 0% credit EMI or Credit Card EMI?

Only the Indian bank credit cards can be used. But you can pay the amount using the Credit card option in one shot / part payments, and later you can convert into EMI from your respective bank. The tenures and interest charged will depend on your bank. upGrad will not charge any processing fees or down payment for these transactions, this will be purely between you and your bank.

7. Are there any charges in case I opt for cancellation/refund from the course after paying balance with no cost EMI ?

Yes, there will be additional charges to the extent of interest paid by the upGrad to the bank, you will be refunded only Principal amount, i.e. the amount actually deducted/blocked from your card. This deduction will be in addition to the amount mentioned in the refund policy shared with your offer letter.

8. Can I Pay Using Multiple Credit Cards ?

Multiple cards can be used to complete the payments using Part payment option make sure to inform the learner, minimum transaction is INR 50000 to opt for 0% CC EMI E.g. Amount to be paid: 150000. I can pay using 2 Credit cards. Yes, Example :

HDFC Card – Part payment – INR 100000

ICICI Card – Part payment – INR 50000

9. How can I opt for Credit card EMI if my bank is not listed in the 0% Credit card EMI or Credit card EMI?

You can pay the amount using the Credit card option in one shot / part payments, and later you can convert into EMI from your respective bank. The tenures and interest charged will depend on your bank. upGrad will not charge any processing fees or down payment for these transactions.

10. Why is the entire amount blocked on my credit card?

Initially your bank will block the entire amount from your available purchase limit and from your next billing cycle, you will be charged the EMI amount. As you start paying your EMI, your credit limit will be released accordingly. For example, if you have made a payment of ₹100000 on 6-months EMI and your credit limit is ₹200,000 then initially your bank will block your credit limit by ₹100000. After payment of your first month EMI of Rs.15000, the blocked amount will come down to ₹85000.

11. Why is interest getting charged on No Cost EMI?

Your bank will charge you interest. However, this interest charge has been provided to you as an upfront discount at the time of your payment, effectively giving you the benefit of a No cost EMI. The total amount paid during the entire EMI tenure to the bank will be equal to the amount to be paid to upGrad.

Eg. Amount payable to upGrad: INR 405000

Let's say Amount deducted at the time of transaction: INR 379850 (Principal amount) Bank charges interest of 12-15% per annum on INR 379850

[Note: Interest factor is reducing rate and not Flat rate]

EMI AMOUNT = INR 33750 x 12 = INR 405000

Effectively, you have taken loan on 379,850 instead of 405,000